If, in the anomalous tax loss year, the taxpayer allocated more than 35% of the tax loss to its limited partners or limited entrepreneurs, then the taxpayer would meet the definition of a syndicate and thus be precluded from using the cash method of accounting under Sec. Although many commenters requested that the definition of a tax shelter or syndicate be modified, the final regulations did not do so, as the IRS and Treasury determined those changes would be contrary to congressional intent.Ī cash- method taxpayer that is usually in a taxable income position may experience an unforeseen tax loss for an anomalous year but return to a taxable income position in a subsequent year. Whether an entity is a syndicate is determined annually. 6662(d)(2)(C)(ii)).Ī syndicate is defined generally as any partnership or other entity (other than a C corporation) if more than 35% of the losses of the entity during the tax year are allocated to limited partners or limited entrepreneurs. Any syndicate (within the meaning of Sec.Any enterprise (other than a C corporation) if the offering of interests is required to be registered with any federal or state agency having the authority to regulate the offering.Taxpayers treated as tax shelters are prohibited from using the overall cash method and are not eligible to be treated as small business taxpayers, even if they meet the annual gross receipts test.

448(c)(2)), and the proration of amounts for short tax years. The final regulations generally retain the existing rules related to the computation of the gross receipts test, including the definition of gross receipts, the requirement to aggregate gross receipts with certain other persons (Sec.

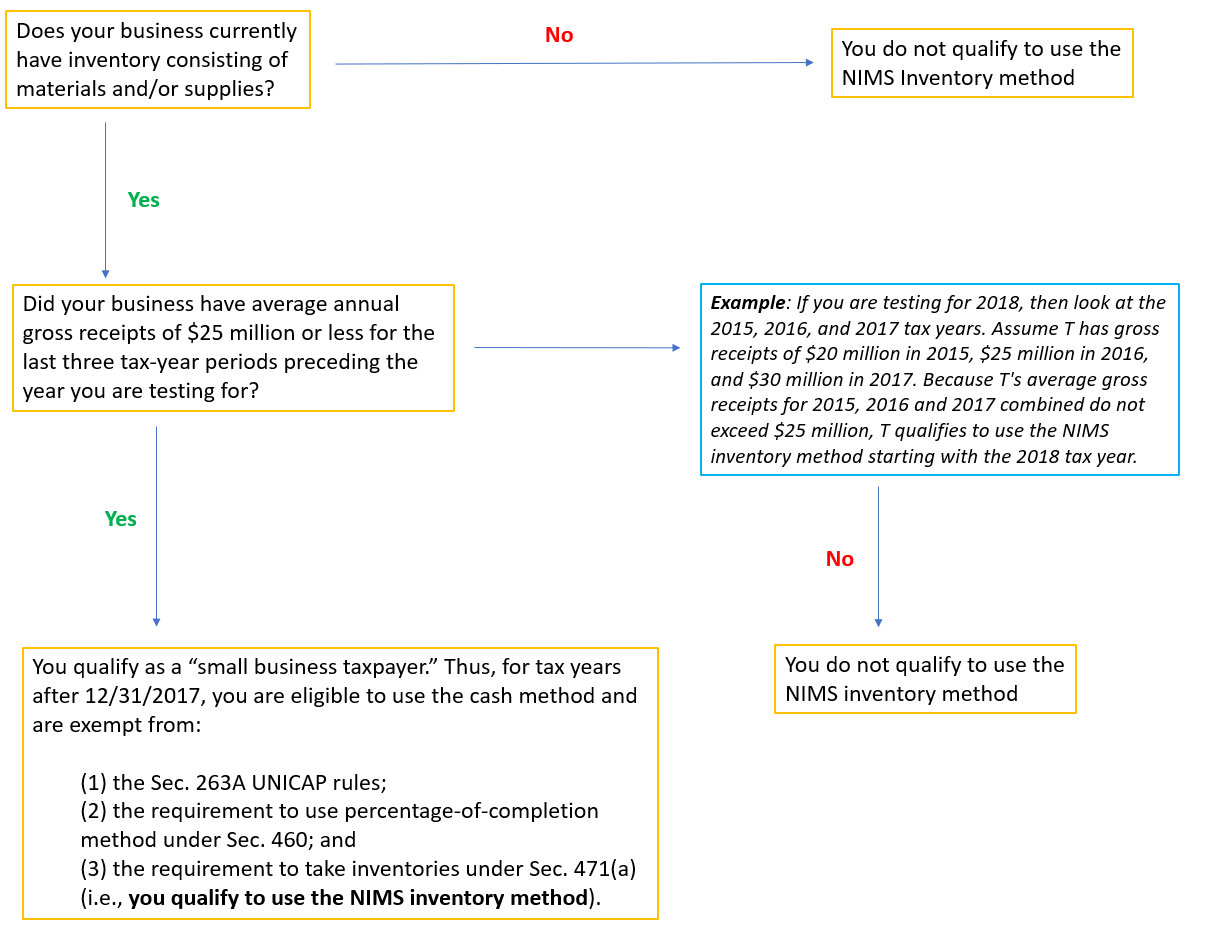

Changes to any of these simplified methods generally require filing one or more Forms 3115, Application for Change in Accounting Method, with the IRS. The inflation- adjusted ceiling is $26 million for tax years beginning in 2019, 2020, and 2021. These simplified tax accounting rules apply to taxpayers with average annual gross receipts of $25 million (adjusted for inflation) or less for the three- tax- year period ending before the current tax year (the gross receipts test Sec. Qualification for the small business taxpayer exemptions The following analyzes these changes and their implications for qualifying small business taxpayers. 163(j), which limits the deductibility of business interest expense. A qualifying small business taxpayer is also exempt from Sec. 263A, and the use of the percentage- of- completion method for certain long- term construction contracts under Sec. 471, uniform capitalization (UNICAP) rules under Sec. These simplifying provisions, which apply to small business taxpayers, expand the use of the overall cash method of accounting and grant exemptions from inventory methods under Sec. The final regulations generally adopt the proposed regulations published in the Federal Register on Aug. 5, 2021, providing guidance to implement several simplification provisions of the law known as the Tax Cuts and Jobs Act (TCJA), P.L. The IRS and Treasury released final regulations (T.D.

0 kommentar(er)

0 kommentar(er)